inSIGHTS

- Financial

advantages

How the time and type of construction affects the financial costs of your home

Financial cost depending on time and type of construction

When it comes to traditional construction, it is common to face lead times that can extend up to 24 months or more in some cases, which lengthens the waiting time to move in and also entails significant financial costs.

At Casas inHAUS we build a house in as little as 5 months. This speed is not only an advantage on a practical level, but also has financial implications that mean considerable savings for the customer. Below, we break down these advantages by comparing the inHAUS modular construction model with traditional construction which can take up to 2 years.

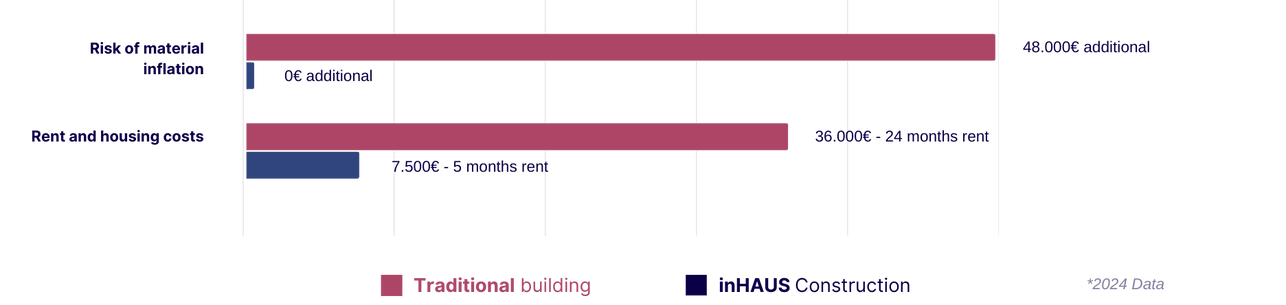

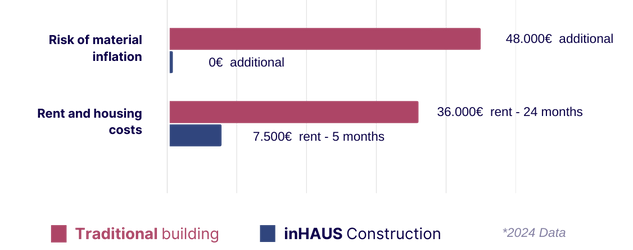

1. Risk of material inflation

The longer the construction lasts, the longer the period in which the client has to bear the risks of inflation and price changes in materials.

Traditional construction (24 months):

Material prices on long projects can rise, increasing the total cost. Assume 3% inflation per year and a house budget of €800,000, this would add an additional €48,000 in material costs.

Sometimes in traditional building work, when the budget is made, these are taken into account and actually this cost is ‘camouflaged in the budget’.

inHAUS construction (5 months):

Price fixation: By manufacturing in less time, there is no risk of material inflation. The price of the house and materials is fixed from the beginning, eliminating the possibility of an inflationary cost overrun of €48,000.

At inHAUS houses all materials are ordered within 24h, just after the financing is accepted and the license is approved. Therefore, there is absolutely no price difference in purchases, nor are you affected by inflation.

2. Indirect costs: rent and housing costs

During the construction of a traditional home, the client is likely to incur rental costs, as the home cannot be lived in until it is completed. This is an expense that can be considerable over two years.

Traditional construction (24 months):

Monthly rent: Let’s assume a rent of €1,500/month while the house is being built. In 24 months, this adds up to €36,000 in rents, not counting other additional expenses such as utilities.

inHAUS construction (5 months):

Monthly rent: Over 5 months, the total cost of rent would be €7,500, a saving of €28,500 compared to a slower construction.

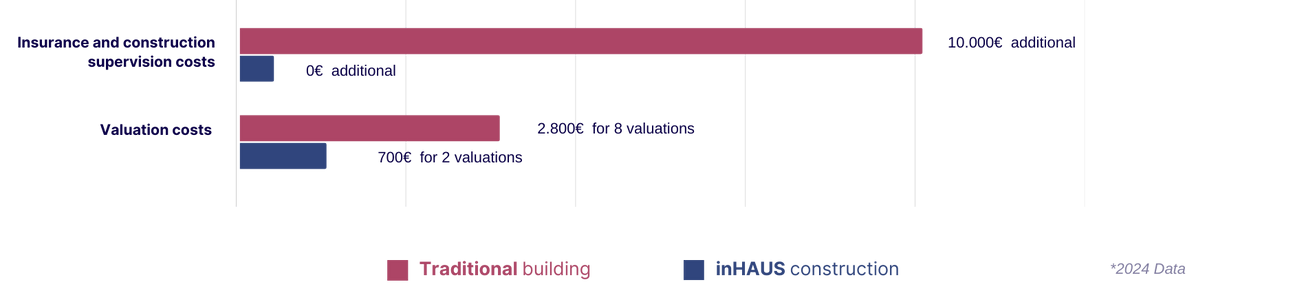

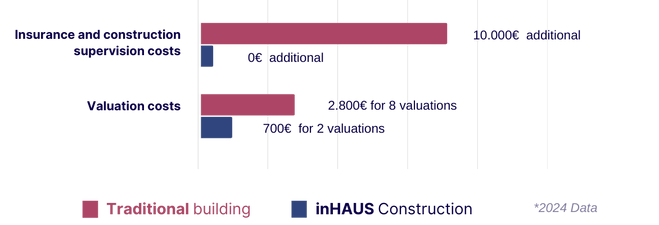

3. Insurance and site supervision costs

During the construction period, the client has to bear the cost of various insurances related to the construction work and the supervision by professionals, such as architects and surveyors. These costs also increase the longer the construction period.

Traditional construction (24 months):

Site supervision: Hiring an architect or quantity surveyor for site supervision can cost €5,000/year. Over two years, the cost would be €10,000.

inHAUS construction (5 months):

As we have all types of professionals on staff, Casas inHAUS includes site management, as it is an industrial process and this control is carried out in the factory itself.

4. Valuation costs

When you apply for a self-promotion loan, the process involves a series of appraisals to assess the completion of the construction phases and release new loan items. Each appraisal involves a considerable cost in the process.

Traditional construction (24 months):

Throughout a traditional on-site construction, several appraisals are carried out: an initial appraisal of the land, partial appraisals during the construction (each time an important phase is completed) and a final appraisal.

Each appraisal has an average cost of €350. If a total of 8 or more appraisals are carried out on a project, the cost can easily reach €2,800 or more.

inHAUS construction (5 months):

In contrast, with our modular system, only two appraisals are carried out: an initial and a final one, with a potential saving of up to €2,100, which significantly reduces the associated costs.

5. Improvement of IRR (Internal Rate of Return)

If the construction is intended for investment, the IRR (Internal Rate of Return) is a key indicator to assess profitability. In a traditional 24-month project, cash flows are delayed, which negatively affects the IRR due to the time it takes to recover the initial investment.

To illustrate the impact on the IRR, let’s consider the simplified formula, considering a project with an initial investment of €800,000 and a projected selling price of €1,100,000. Net income would be €300,000, but time is key in how this translates into profitability.

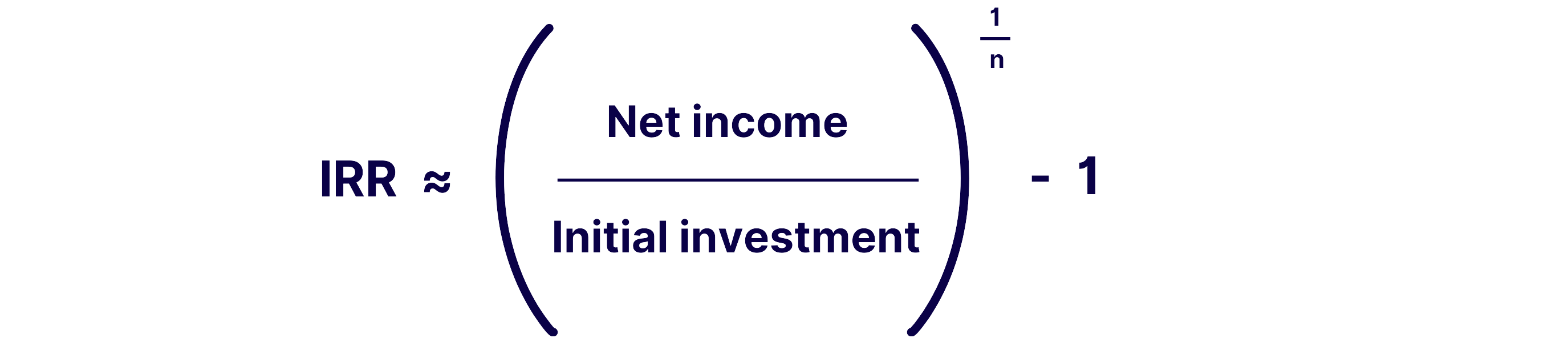

Simplified IRR formula:

– Net income is total income minus accrued costs.

– Initial investment is the amount invested at the beginning (negative).

– n is the number of periods (in years, we will use months*).

NOTE*: We are going to use months as periods this time, as it allows us to approximate a more realistic calculation in terms of exponents. This will mean that we will get a monthly IRR. In addition, the IRR calculation being simplified, we assume that there is only a single net income (the gain from the sale of the house) and a single initial investment at a given point in time (no negative or positive cash flows in different periods).

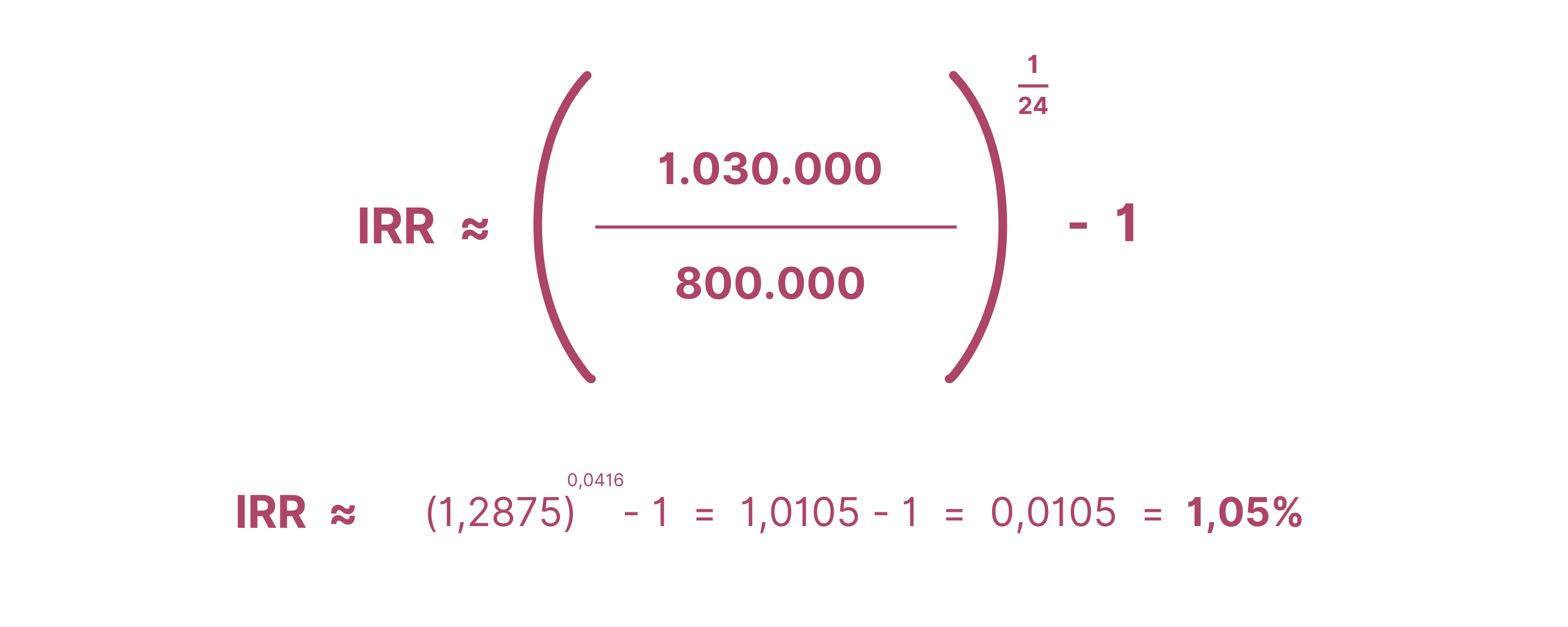

Traditional construction (24 months):

Factors affecting IRR in traditional construction:

– Financial Costs: For 24 months, the developer continues to pay interest on the financing (if any). Also, as long as there is no sale, there is no positive cash flow.

– Inflation and Operating Costs: The longer the project is extended, the more expenses such as insurance, material storage costs, machinery rentals, salaries, etc. accumulate.

– Delayed Revenues: The developer will not see revenues until after 24 months, which decreases the time-adjusted profitability.

Estimated calculation:

To simplify the example, let’s assume that the financial and operating costs over the 24 months amount to €70,000.

The data for the calculation would be:

– Initial investment: 800.000€

– Net income after 2 years:

1.100.000€ – 70.000€ = 1.030.000€

– n = 24 months

Interpretation: With this information, the estimated IRR is 1.05% per month, as profits are eroded by the time it takes to generate the return and the additional costs that arise during the long construction process.

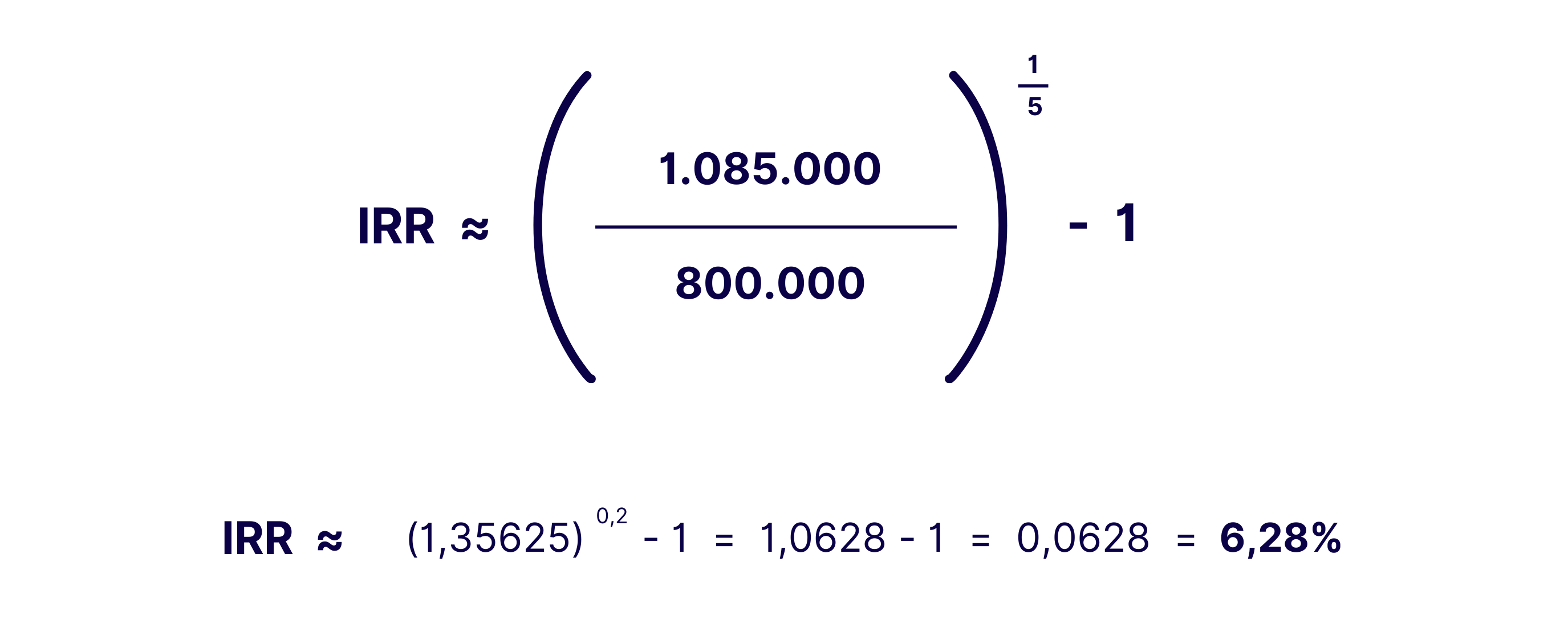

inHAUS construction system (5 months):

The same project is realised in 5 months under the inHAUS model. The benefits of this model are based on speed, which significantly reduces financial costs and accelerates positive cash flows.

Factors that improve the IRR inHAUS construction:

– Lower Financing Costs: By completing construction in 5 months, the interest or financing costs are much lower.

– Lower Operating Costs: Less time means fewer insurance payments, salaries and other expenses.

– Accelerated Income: By selling the house much sooner (in only 5 months), the developer can reinvest or make a profit more quickly.

Estimated calculation:

In this case, the operational and financial costs are significantly reduced, say to €15,000 instead of €70,000.

The data for the calculation would be:

– Initial investment: 800.000€

– Net income after 5 months:

1.100.000€ – 15.000€ = 1.085.000€

– n = 5 months

Interpretation: With this scenario, the IRR is much higher, as the return occurs in a much shorter period of time and with lower costs. The estimated IRR is 6.28% per month, due to the combination of lower costs and a faster return.

*NOTE: The scenario presented is studied through the simplified IRR formula, for a better approximation and correlation to the profitability of each project, it is recommended to use the full NPV formula. This formula would include different negative and positive cash flows for each period.

6. Increased ROI (Return on Investment)

After observing the difference in profitability between projects based on time as a fundamental element, we proceed to calculate the ROI of each investment in order to have a broader view of the profitability of each project and approximate the economic advantages.

To calculate the ROI we have taken into account the initial data, a project with an initial investment of €800,000 and a projected sale price of €1,100,000. In the case of the inHAUS system, the profit from the project amounts to €1,085,000, while in the traditional construction site, the net income is reduced to €1,030,000 due to the higher costs associated with the project. This is due to the costs after extending the project over time, higher expenses, inflation…

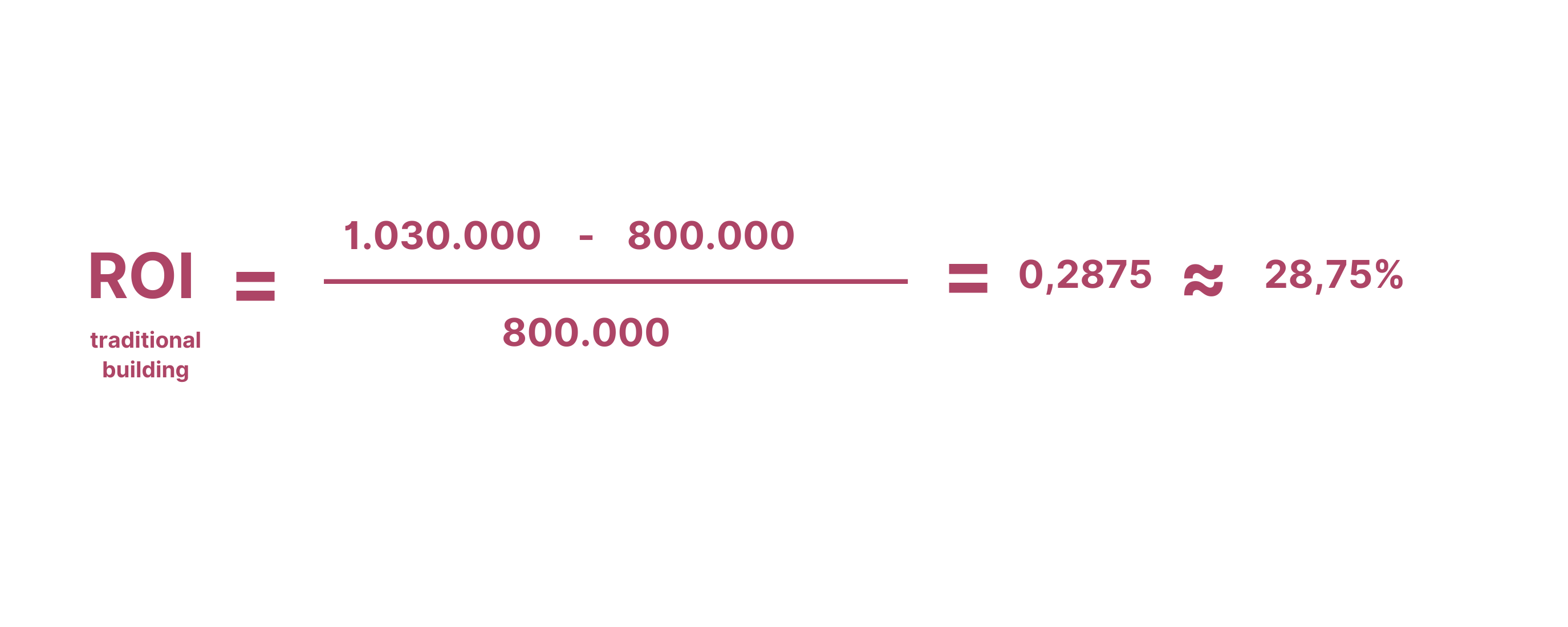

Traditional construction (24 months):

Estimated calculation:

The data for the calculation would be:

– Initial investment: 800.000€

– Net income after 2 years:

1.100.000€ – 70.000€ = 1.030.000€

Interpretation: With this information, the ROI of the traditional construction project is 28.75%. This indicates that the investment is recovered in monetary terms, and that there is a profit of approximately €0.28 for every euro invested.

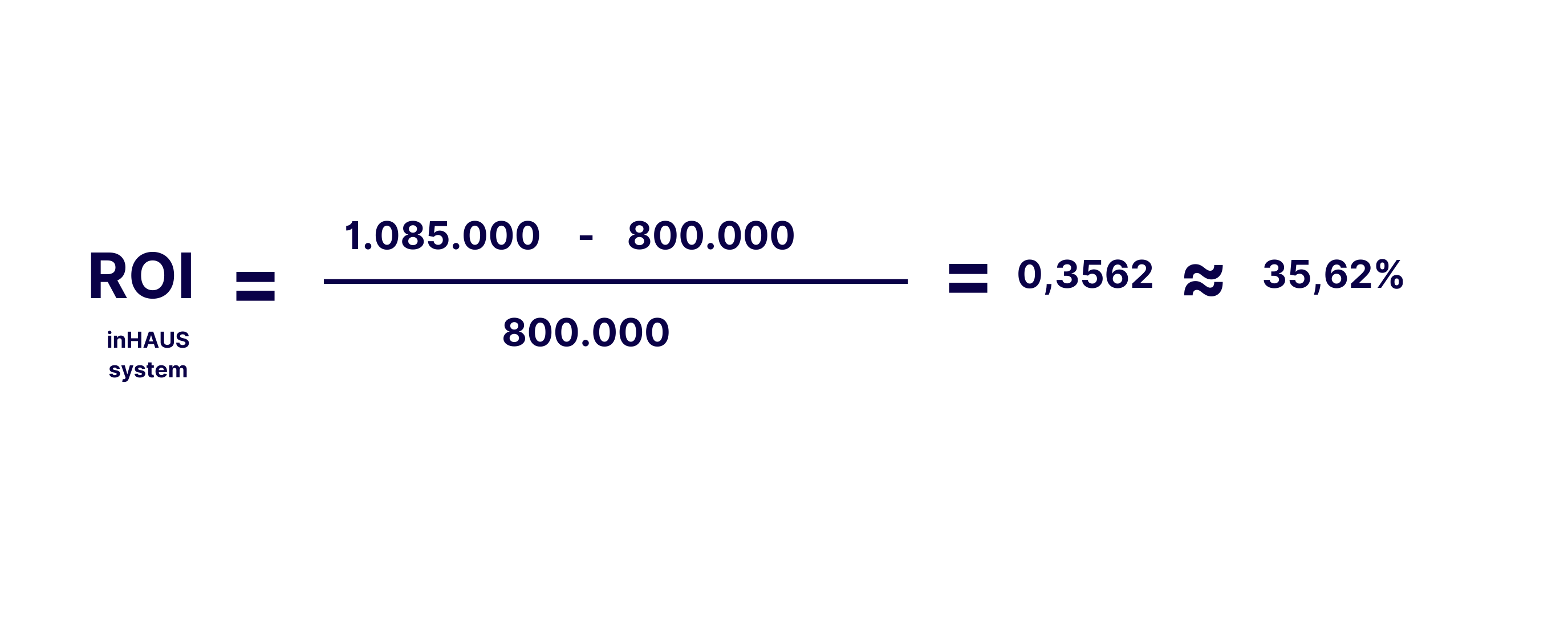

inHAUS construction system (5 months):

Estimated calculation:

The data for the calculation would be:

– Initial investment: 800.000€

– Net income after 5 months:

1.100.000€ – 15.000€ = 1.085.000€

Interpretation: With this scenario, the ROI of the project built with the inHAUS system is 35.62%. This means that in addition to a full return on investment, we get approximately €0.35 profit for every euro invested. This is due to the combination of lower costs and a faster return.

Conclusion

The speed of inHAUS modular home construction brings not only practical, but also significant financial benefits. By reducing build time to just 5 months, clients minimise the risk of material inflation, indirect costs such as rent, insurance and site supervision, and drastically reduce the number of appraisals required. For investors, this speed also improves the IRR, allowing returns to be achieved in less time and with lower cumulative costs and a higher ROI, making modular construction an economically sound and attractive option.

Contact us

Whether you are an individual or a professional, do not hesitate to contact us for further information, to request a personalised quote or to make any enquiry.

Contact form

Consult models and prices

In our Catalogue 111 you have more than a hundred models of houses to choose from. Register to access information and prices of all models.